Home Loans

Our Home Lending Products Make It Easy

Capital Farm Credit is more than just a farm and ranch lender. We have home loan specialists located throughout our territory, offering expertise in financing your home in the country.

Our home lending products make purchasing, building, or refinancing your home easy. We offer a variety of fixed- or adjustable-rate options.

We understand rural lending, to make the process simple for you. And our team is well-versed in rural living and lending because they’ve been doing it for more than 100 years, so you can count on us to help you through the entire process.

Finance or Refinance Any Type of Home Loan

We can lend on homes and home construction, valuing both acreage and improvements.

Choose the Down Payment Option That Fits

Many lenders require a large down payment to avoid personal mortgage insurance (PMI). Working with Capital Farm Credit, you have several down payment options to fit your individual needs. PMI may be required in some instances.**

We offer:

- Flexible rates and terms

- Rural homesites (land) loans

- Purchase loans

- Construction loans

- Refinance loans

- Second home and investment property loans

- FHA loans/VA loans

- Financing inside or outside city limits

- Home Equity/Cash Out Loans - Secondary Market only

Advantages:

- No acreage restrictions

- Competitive rates

- Reasonable fees

- Retain Ag Tax Valuation

- Financing for metal homes

.jpg?sfvrsn=cfdbf0f9_0)

MORTGAGE LOAN OFFICER

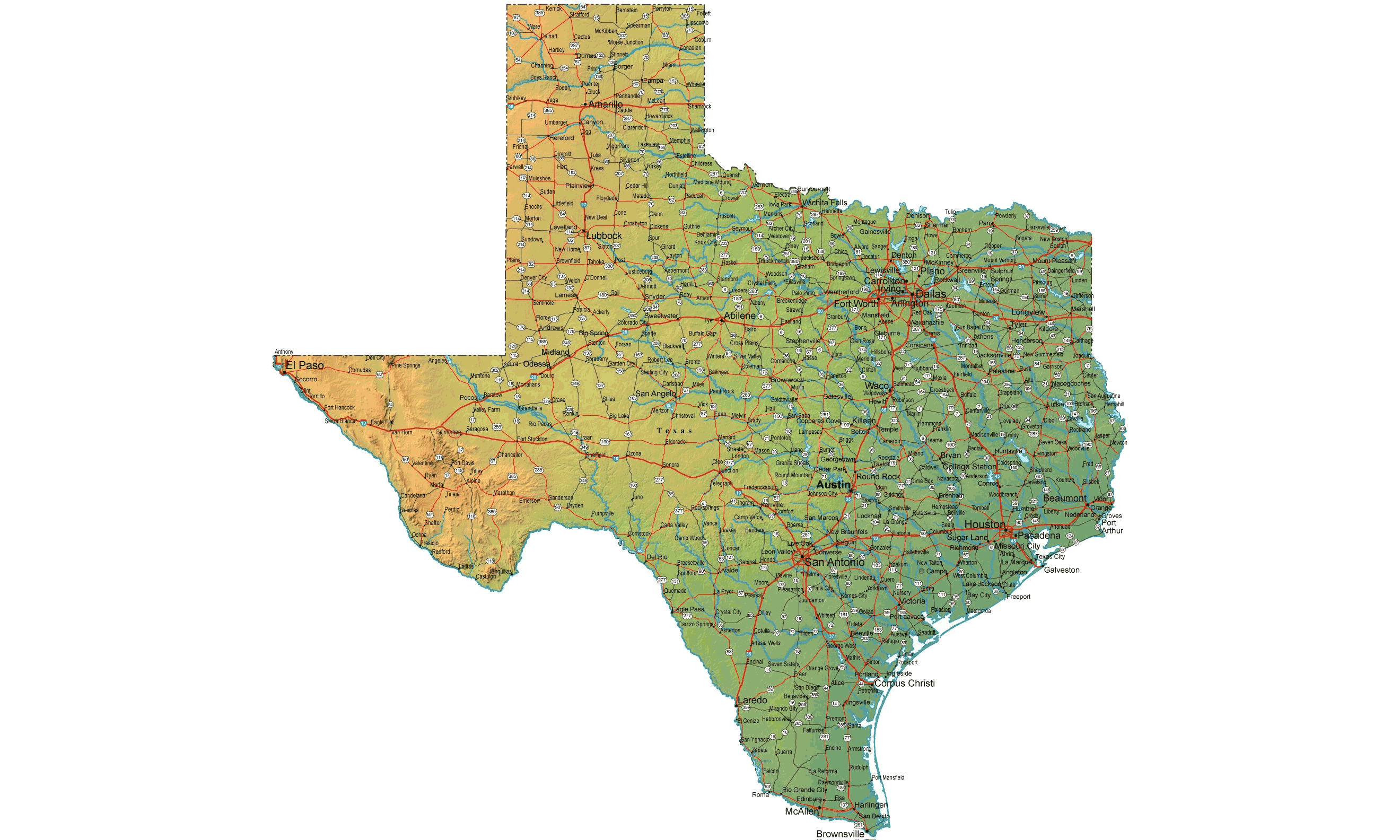

We have home lending specialists across Texas. Find one near you.

Locate One Today*A $200,000 loan would require a 15% down payment with a monthly principal and interest payment of $1192.68 for 360 months based on 6.16% annual percentage rate (APR). Assumes $4,500 in closing costs. Monthly payments do not include amounts for taxes and insurance premiums so the actual monthly payment will be greater if an escrow account is established. Available rates and terms including the APR are subject to change without notice. The APR is based on the best available interest rate as of 05/02/2022.